Mortgage Market Watch Commentary

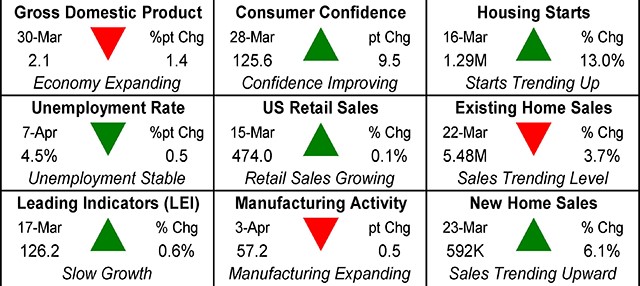

Mortgage Market Watch rates drifted slightly lower again last week, with mixed economic news. While US military action can often impact markets, the air strikes in Syria had a somewhat tempered impact. The Fed’s meeting minutes did contain some important news. At some point later this year, the Fed will begin to wind down its massive holdings of Treasuries and Mortgage-Backed Securities. We’ll have to wait to see the exact impact, but if private markets don’t have much appetite for the securities, rates will tend to drift upward. March’s employment report was very mixed, with unemployment falling to the lowest level of the recovery, but only 98,000 new jobs were created. Some analysts are beginning to worry about wage-driven inflation, but we really aren’t to a point to get too concerned, yet.

The first part of this week may see rates impacted more by politics and market sentiment than any solid economic data. The most important data comes at the end of the week with the CPI and Retail Sales. If Sales falls further than expected and the CPI rises, then rates might begin trending upward.